UNEMPLOYMENT BENEFITS DURING COVID-19

Last updated 3/23/2021

The information provided on this website is for general informational purposes only and does not constitute legal advice. Please contact Pisgah Legal Services or a private attorney if you need to speak with an attorney regarding your specific situation. You can apply online for Pisgah Legal at www.pisgahlegal.org/free-legal-assistance or call 1-800-489-6144.

If you have questions about securing unemployment compensation, please check the resources on this page. If you need information on your rights as an employee, click here. If you need legal advice about an employment-related matter, you can apply to Pisgah Legal for help online at www.pisgahlegal.org/free-legal-assistance or call 800-489-6144.

Update: Taxation of 2020 unemployment benefits

The American Rescue Plan Act of 2021 made the first $10,200 of 2020 unemployment benefits tax free for taxpayers with an adjusted gross income less than $150,000.

The IRS has provided a statement in response to this change, which is available here. As of March 12, 2021, the IRS recommends as follows:

“For those who haven’t filed yet, the IRS will provide a worksheet for paper filers and work with software industry to update current tax software so that taxpayers can determine how to report their unemployment income on their 2020 tax return. For those who received unemployment benefits last year and have already filed their 2020 tax return, the IRS emphasizes they should not file an amended return at this time, until the IRS issues additional guidance.”

How do I qualify for unemployment benefits?

Under normal circumstances (without a pandemic) you may qualify for regular state unemployment benefits if:

- You are unemployed through no fault of your own

- You worked for an employer who paid into the NC Unemployment Insurance Fund

- You earned enough wages in at least two calendar quarters out of the last 5 quarters

- You are not disqualified from receiving benefits due to misconduct, or for leaving work for a reason other than good cause attributable to the employer, or other disqualifying status

- You are able and available to work, including that you are legally authorized to work in the U.S.

- You are actively seeking work; and

- You file a claim for unemployment benefits and register for work with NC Works.

Due to COVID, Governor Cooper has waived the following requirements while the public health emergency is in effect:

- There is no one-week waiting period to receive benefits once you are approved

- There is no work search requirement to get unemployment benefits for claims filed before March 14, 2021.

- Employers’ unemployment accounts are not charged for the unemployment benefits that their former employees receive if the unemployment was related to COVID-19.

If you are unable to work because of COVID-19, or you are not eligible for regular state unemployment benefits, perhaps because you were self-employed, or if you have used up all other state and federal unemployment benefits, you may be eligible for federal Pandemic Unemployment Assistance (PUA) benefits. Contact the PUA Hotline at 866-847-7209 to find out more information.

All of the following are required for you to be eligible for PUA benefits:

- You must not be eligible for regular state unemployment benefits or any other unemployment benefits or other paid leave. This includes people who are self-employed, independent contractors, gig workers, those who just started a job recently and got laid off, or those who had a job offer rescinded. It also includes those who have exhausted their regular state unemployment

- You can’t work like usual because of COVID-19. Here are some examples:

- You have COVID-19 or have symptoms and are trying to get diagnosed. This does not require a positive COVID-19 test.

- You are caring for a family member who has COVID-19

- Your child’s school is closed because of COVID-19. If the school is providing only online instruction, or if the school is requiring part-time online instruction with part-time in-school instruction, then the school is viewed as being “closed.” But if the school permits you to choose between online instruction or in-person instruction, then the school is viewed as being open.

- Your workplace is closed because of COVID-19

- You had to quit your job because of COVID-19

- Your job offer was pulled because of COVID-19

- You are otherwise able to work and available for work except for these COVID reasons

- You are not able to get paid for working from home

Here are some common reasons your employment may have been affected by COVID-19

- Your employer cut your hours or laid you off because the business is closed or has reduced hours

- Your employer told you to stay home because you traveled to a location with a high rate of infection

- You cannot work because a health care provider advised you to self-quarantine, even though your workplace is open

- You cannot work because you cannot get childcare and schools or daycares are closed

If your ability to work has been affected by COVID-19, you should get documentation to provide to DES, such as: Documentation from medical professionals related to diagnosis, or isolation instructions; notices from school or child care providers; notices from county or state government regarding business closures or stay-at-home orders; and/or documentation that a job offer or need for your services was cancelled or delayed because of COVID-19.

If you are self-employed, documents that can show your income include your last filed tax return; recent paycheck stubs; bank receipts; 1099 Forms; billing statements or invoices; business licenses; contracts, invoices, and ledgers.

If you are getting paid leave through your employer, you must use that leave before you will receive unemployment benefits. If you take job-protected leave, you have the right to return to the same or equivalent position with the same employment benefits, pay, and other terms and conditions of employment.

Where can I get more information on Unemployment Insurance Benefits?

Check back on our website for updates and check the NC Division of Employment Services website for up to date information on how the Division of Employment Services (DES) is administering unemployment claims during COVID-19.

If you are unsure whether you would be eligible for unemployment benefits, you should apply at www.des.nc.gov.

How do I apply?

- Apply online at www.des.nc.govor call DES at 1-888-737-0259

- File a claim

- Once you have applied you will need to start completingweekly certifications (you need to file weekly certifications even if there has been no decision in your case). To find out more on how to file your weekly certifications go to https://des.nc.gov/apply-unemployment/file-your-weekly-certification.

DES recommends that you apply online because the telephone system is often overwhelmed with calls. If you apply online, it is best if you use a computer instead of a phone.

- Video on How to Create an Online Account with DES

- Instructions on How to Create an Online Account

- Fact Sheet on Applying for Unemployment Insurance Benefits

I am having problems applying

If you have previously created an online account, you must log back into that account, since you cannot create a new account. For issues with online accounts or applications, complete a DES Customer Contact Form. You can also get assistance with your online account at DES FAQs on Online Account Help.

How much will I receive in Unemployment Benefits?

The maximum benefit an individual can receive in North Carolina is $350 per week. The formula generally aims to provide an individual with half of their average weekly salary, up to the max of $350. The minimum an individual can receive in regular state unemployment benefits is $15 per week. The minimum for federal PUA benefits is generally half of the state’s average weekly benefit amount, normally over $100 per week. The additional $600 federal supplement expired at the end of July, but if you were unemployed between April 4th, 2020 and July 25th, 2020 and you are approved for benefits, you should receive this amount retroactively. A $300 weekly federal supplement is available through September 6, 2021.

Is there a supplemental payment?

The $600 weekly supplement was in effect for weeks ending April 4 through July 25. This program was reinstated at a lower $300 weekly rate beginning December 27, 2020, and has been extended until September 6, 2021.

Additionally, two prior programs provided a supplemental payment for eligible claimants.

The “Lost Wages Assistance” (LWA) program will provide an additional $300 per week for the weeks ending August 1 through September 5, 2020. To be eligible for the additional LWA supplement, you must:

- Be receiving at least $100 per week in unemployment benefits from any other state or federal source; and

- You may need to self-certify that you are unemployed due to a COVID-related reason – these reasons are listed under the PUA benefits description above. If you need to self-certify, you will see a link on the Customer Menu page in your online account to ‘File Lost Wages Assistance Certification.’ If you do not see this link, you do not need to complete this certification.

The “Increased Benefit Amount” (IBA) program will add $50 per week for eligible claimants, for the weeks ending September 6 through December 26, 2020, or whenever funds are exhausted, whichever is earlier. Eligibility depends on whether you are receiving state or federal benefits, and when you initially filed for benefits. You do not need to file a separate claim for IBA benefits, and payments should begin around October 30, 2020. Please see the DES website for further information on eligibility: IBA Eligibility

How long can I get benefits?

The standard benefit period for state unemployment benefits is 12 weeks. However, legislation passed in response to COVID-19 has provided an additional 53 weeks of benefits once the initial 12 weeks has been used up. You must apply for this extension through your online account; it won’t be automatically granted. Individuals who have exhausted all other available benefits may apply for PUA benefits. PUA is available for up to 79 weeks of benefits, offset by weeks of certain other benefits you received. You can contact the Pandemic Unemployment Assistance Helpline at DES at 866-847-7209 with questions. The federal extension of state benefits, PUA, and the $300 federal weekly supplement to benefits are all set to expire September 6, 2021.

What if I’m still working?

You may be eligible even if you are not fully unemployed. Earnings while claiming benefits must be reported and may impact the benefit amount you receive. If you are unsure whether you would be eligible for unemployment benefits, you should apply at www.des.nc.gov.

Generally, earnings up to 20% of your weekly benefit amount will not reduce your benefit; earnings in excess of 20% of your weekly benefit amount will reduce your benefit dollar-for-dollar, potentially reducing your benefit to $0. If you are receiving unemployment benefits and begin working, be sure to report to DES that you are working, and report your earnings in the week that you earned money, not the week in which you get paid. If you fail to report your earnings while receiving unemployment benefits, DES can collect an overpayment from you and possibly file fraud charges against you!

Does my immigration status affect my eligibility for benefits?

Generally, to be considered “able and available” for work, an individual must have work authorization. For more information, watch presentation by PLS Attorney Shoshana Fried in Spanish and English at www.pisgahlegal.org/facebook-live-updates/

Get more information here: Immigration Status and Unemployment Benefits:

Appeals Process

The fastest way to file an appeal or protest is by logging into your account online. For further information on appeals, see the DES website at https://des.nc.gov/appeals/file-appeal

Wage Transcript and Monetary Determination: The wages shown on the Wage Transcript will determine the amount of benefits you receive, so review it carefully. If you disagree with the amounts shown for your wages on this form, you have only 10 days from the date of mailing to file a protest. File your protest online when you sign into your account, or fax it to 919-733-1255, or mail it to PO Box 26504, Raleigh, NC 27611-6504. If the protest is not resolved in your favor, then you will have 30 days to appeal that decision.

Claim Denial: Generally, if your claim for benefits has been denied by an adjudicator, you have 30 days from the day the notice was mailed to file an appeal to request review by an appeals referee. Your determination notice should include information on where and how to file your appeal. Once you file your appeal, DES will schedule a hearing with an appeals referee. To file an appeal of a first-level claim denail:

- File your appeal online when you sign into your account; or

- Fax your appeal to 919-857-1296, or email it to [email protected]. However, note that it takes DES longer to respond to faxes and emails; or

- Mail your appeal to: DES Appeals, P.O. Box 27967, Raleigh, NC 27611-7967. Note that this option will take the longest.

Higher Levels of Review: If you disagree with the Appeal Referee’s decision, you have ten (10) days to file an appeal to the Board of Review. If you disagree with the Board of Review’s decision, you have a right to file an appeal in NC state courts.

For appeals of matters other than initial claim denials, or for higher level appeals, see the contact information on your determination letter or use the DES contact information located here: DES Contact List.

If you are an employee and need additional help or are denied benefits for any reason, please contact Pisgah Legal Services. You can apply for PLS services online 24/7 or apply by phone, Monday through Friday, 8:30am to 5:00pm, 828-253-0406 or 1-800-489-6144

Resources for Employees Applying for Unemployment due to COVID-19

I am an employer with questions:

DID YOU KNOW?

Qualifying for Unemployment

Insurance during COVID-19You may qualify for unemployment insurance related to COVID-19 if, because of the virus, you lost your job, had your hours reduced, can’t work because of a medical condition, or are following direct quarantine orders. There are also some situations in which you may qualify if you resigned or you were fired for not following internal rules. If you are not sure, apply.

You must be a U.S. citizen or legally present with work authorization (including persons with DACA and TPS) in order to qualify for benefits.

There is no waiting period and no work search requirement to get unemployment benefits under these circumstances.

All applications during the COVID-19 crisis must be filed online or by phone: https://des.nc.gov or 1-888-737-0259.

Has your application for unemployment benefits been denied or delayed? Apply for legal help from Pisgah Legal online at www.pisgahlegal.org/free-legal-assistance/ or by phone at 1-800-489-6144.

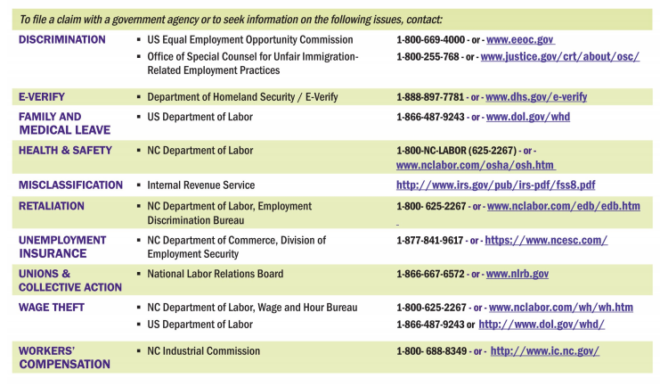

To file a claim with a government agency or to seek information on the following issues, contact the resources below:

The information provided on this website is for general informational purposes only and does not constitute legal advice. Please contact Pisgah Legal Services or a private attorney if you need to speak with an attorney regarding your specific situation. You can apply online for Pisgah Legal at www.pisgahlegal.org/free-legal-assistance or call 828-253-0406.